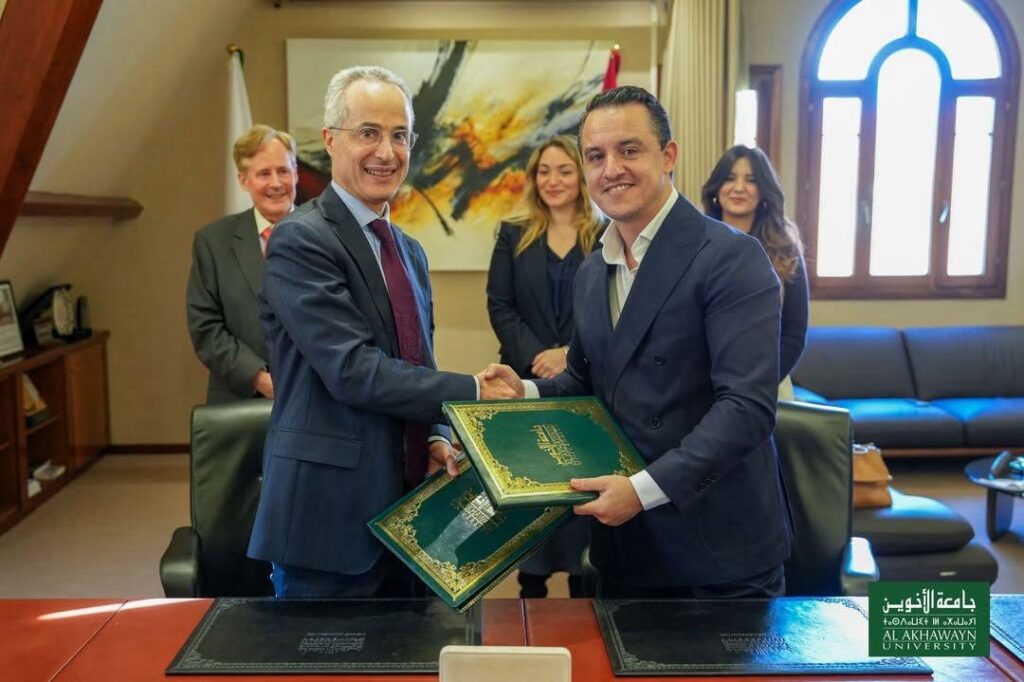

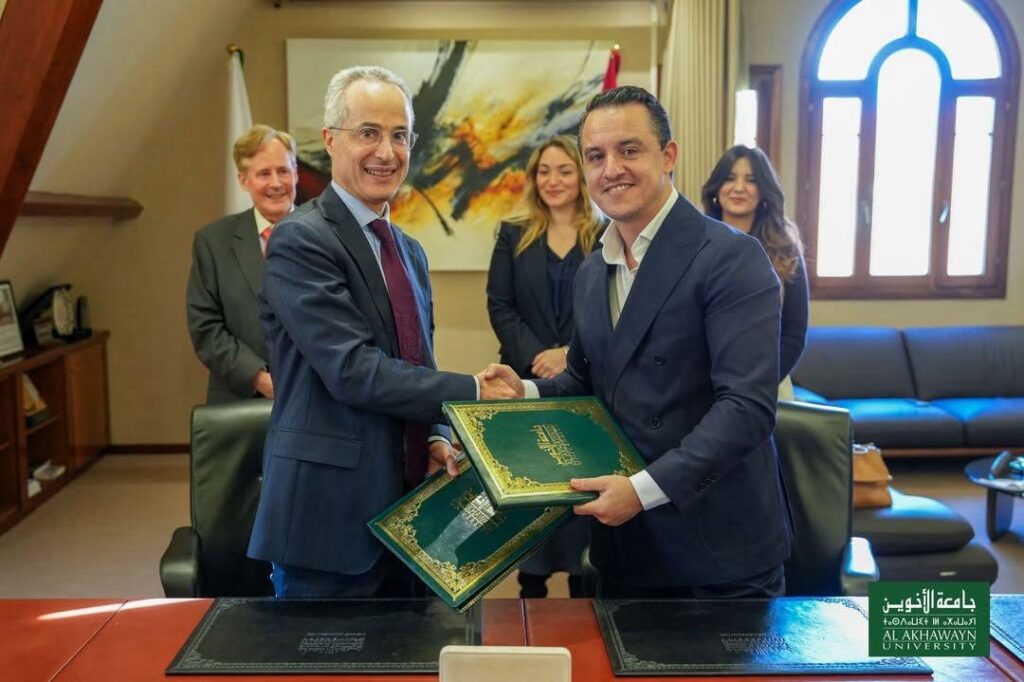

Lotus Capital Academy Partners with Al Akhawayn University to Launch the Executive Trading Certificate

November 2024

November 2024

Lotus Capital Academy Partners with Al Akhawayn University: A New Era in Finance Education

November 2024

We are excited to announce a groundbreaking partnership between Lotus Capital Academy (LCA) and Al Akhawayn University (AUI). This collaboration represents a significant step forward in finance education, combining the expertise of Lotus Capital in practical financial training with the academic excellence of AUI. Together, we are committed to nurturing the next generation of finance professionals and leaders through innovative programs and unparalleled learning experiences…

November 2024

Introducing Lotus Capital Academy: Bridging Academia with Market Expertise

October 2024

October 2024

Understanding European

Options

And The Black-Scholes Model

September 2024

Financial derivatives are sophisticated instruments whose values are determined by the performance of an underlying asset or group of assets. These derivatives span a diverse range of types, each with unique characteristics. Here, we’ll focus on a particular kind: options. Using tools from stochastic analysis, we aim to understand how to derive the fair value of a class of options, an essential concept in finance.

The options we’ll discuss are European options. These contracts grant the holder the right, without the obligation, to complete a specific transaction at a pre-set time (maturity) for an agreed price. European options are classified as follows…

September 2024

The Black-Scholes Equation

The no-arbitrage condition enables us to derive a partial differential equation (PDE), known as the Black-Scholes equation, to determine the option price Πt\Pi_tΠt . If we assume Πt=F(t,St)\Pi_t = F(t, S_t)Πt =F(t,St ) for a smooth function FFF, then FFF must satisfy: ∂tF+rS∂sF+12σ2S2∂s2F−rF=0\partial_t F + r S \partial_s F + \frac{1}{2} \sigma^2 S^2 \partial_s^2 F – rF = 0∂t F+rS∂s F+21 σ2S2∂s2 F−rF=0 with the terminal condition F(T,s)=Φ(s)F(T, s) = \Phi(s)F(T,s)=Φ(s), where Φ\PhiΦ represents the payoff function, which could be Φc\Phi_cΦc or Φp\Phi_pΦp depending on the option type

Novembre 2024

Limitations Of The Black-Scholes

Model

While the Black-Scholes model is a powerful tool in options pricing, it is not without limitations. This model makes simplifying assumptions (e.g., constant volatility and interest rates) that may not hold in reality. In future articles, we’ll explore some of these limitations and discuss potential model adjustments to better capture real-world market behavior.

Novembre 2024